Quants actively develops securities and risk indices for smart beta investing. The securities portfolios are determined according to the investment objectives of the customers. The portfolios are then optimized according to their volatility characteristics with derivative overlays to achieve better risk-adjusted returns. The client portfolios often follow various securities indices and the volatility optimizations can be streamlined by standardizing for the major indices. Quants has built risk indices on major S&P Dow Jones® broad market and sector indices that track the metrics of its volatility optimizations with derivative overlays.

Derivative Overlays for Smart Beta

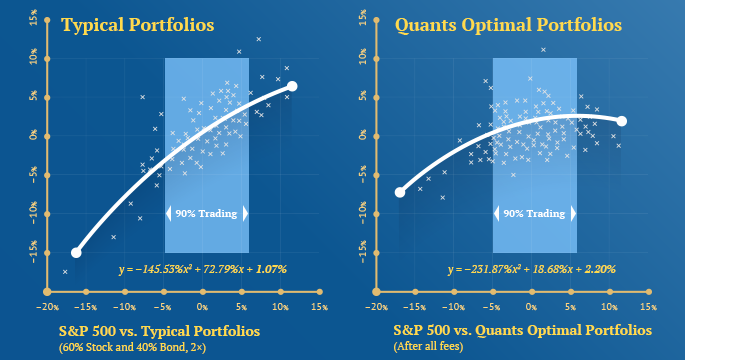

Quants optimizes the portfolio volatility by applying custom derivative overlays with proprietary quantitative algorithms. Quants Smart Beta Overlays are about selling the excess return and optimally hedging the risk according to the historical and implied volatility characteristics of the securities in the portfolio.

Quants has built risk indices for broad market indices by using its proprietary quantitative risk and return analysis and optimization technology. These indices continuously measure the performance metrics of the optimal smart beta overlays and can be easily integrated into any portfolio construction for smart beta investing. The performance metrics are driven by the pricing of the standardized index and sector derivatives contracts trading on the public derivatives exchanges.

Derivatives like futures and options contracts can help the investors protect their investments, even if prices of securities move in the wrong direction. The standardized derivatives contracts are listed on the derivatives exchanges such as CME (Chicago Mercantile Exchange), CBOE (Chicago Board Options Exchange), CBOT (Chicago Board of Trade), and CFE (Chicago Futures Exchange).

Quants Securities Indices represent the optimal combinations of securities portfolios and Quants Smart Beta Overlays for a particular market or a portion of it.

Value Proposition of Quants Risk Indices

Quants Risk Indices differentiate from currently listed derivative indices to enhance volatility (ETF) products by offering the following features:

- Enhance continuously a specific risk and return volatility profile for smart beta investing

- Provide optimal portfolio insurance while generating credit income in steady markets

- Volatility metrics and premium cost management for easier integration to existing portfolios

- Represent derivative overlays that are structured trades with derivatives contracts

- Streamline and democratize the sophisticated risk and return optimization of portfolios

Upcoming Quants Risk Indices

The Risk Indices in US derivatives which are currently used to build Risk ETF products;

- Quants Index Volatility Indices – These indices represent the volatility metric of the derivative overlays to achieve optimal risk and return management in smart beta index investing. The theoretical trades would consist of selling short index futures and opening credit spread positions at the volatility boundary. The volatility boundary is chosen according to a weighted average of at-the-money index options in real-time.

- Quants Sector Volatility Indices – These indices represent the volatility metric of derivative overlays for S&P Dow Jones® sectors to achieve better risk-adjusted returns in any portfolio. The theoretical trades consist of stock options of sector components by using put spreads and call credit spreads up to volatility boundary. The volatility boundary is chosen according to a weighted average of the implied volatility metrics of at-the-money options.

- Quants Index and Sector Risk Premium Indices – These dividend indices represent the annual income generated by the theoretical derivative overlays. The theoretical derivative overlays consist of credit spread positions for optimal risk and return management in smart beta investing. The dividends are paid monthly.

Quants Smart Beta Index

Quants Smart Beta Index is used by Quants Liquid Alternatives and consists of traditional stock, bond and commodity index assets with the risk and return optimizations in derivative overlays. The strategies of the derivative overlays intend to generate continuously better risk-adjusted returns within the portfolio’s implied volatility.

The securities composition of the allocations consists of US large cap stocks, US government bonds and broad commodities. The portfolio is rebalanced on a monthly basis or whenever the asset distribution deviates more than 5%. The volatility optimizations use derivative overlays that track Quants Volatility and Risk Premium Indices and maintained continuously. Please inquire for further details.

Quants Smart Beta Index Characteristics

- The securities account for about %65 of the overall portfolio and the composition of the securities is similar to traditional index investments.

- The risk and return optimization of the portfolio with derivative overlays correspond to about 10-15% of the portfolio and provides great support against the drawdown (when the stock prices are declining).

- The derivative overlays trade off the excess return of the securities to hedge against the risk according to the implied volatility of index assets.

- The index will underperform during the very strong trends.

- The portfolio is leveraged 1.5 times, please inquire for further technical details.

What Is The Purpose of an Index?

An index, when used with respect to financial markets, is a statistical measure of change in a securities market. Indexes, or indices (both are correct in American English), are imaginary portfolios of securities (usually stocks) representing a particular market or a portion of it.

Generally, an index has three main purposes:

- An Index shows the performance of a basket of equities instead of just a single equity – IE an index is diversified.

- An index can show the performance of a particular class of assets – for example, a biotechnology index would show the performance of a diverse group of biotech companies over time.

- An index can also be used to provide a generic securities category for passive management and derivatives (passive investing).