Quants has launched domestic and offshore Liquid Alternative Smart Beta Index Funds in Q4 2015 that were built to outperform the benchmark equity indices. The innovation in smart beta that Quants introduced with derivative overlays and their performance metrics targets to reduce the risk in the index portfolios and potentially achieve better risk-adjusted returns.

How Quants Outperforms Benchmark Equity Indices

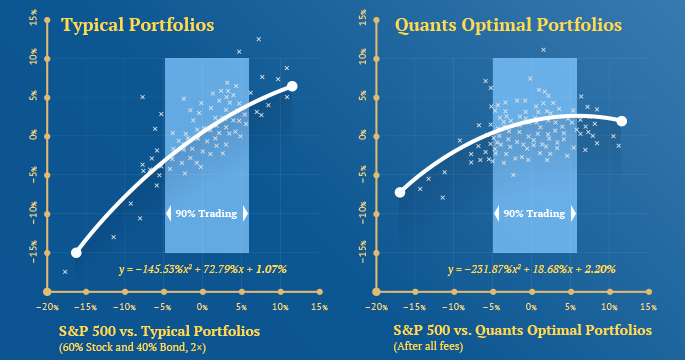

The biggest challenge in a diversified portfolio is to outperform the generally accepted benchmarks during strongly trending markets. Quants Liquid Alternatives use the S&P 500 Index as its performance benchmark. The diversified portfolios may under perform this major equity index and allocations may not always provide adequate protection during volatile markets. The assets may simply stop negatively correlating with each other and break the intended diversification. These limitations are overcome with derivatives strategies.

The portfolio optimizations consist of various combinations of Quants Smart Beta Overlays. Quants developed statistical derivative models in volatility arbitrage to seek predictable behavior in reaction to the changes in the equity assets, mainly in the S&P 500 Index volatility. They are designed to either not correlate with the underlying assets at all, or inversely correlate during excessive volatility. Hence, they are used to generate additional return (alpha) within the optimal volatility range of S&P 500 Index and enhance protection against the excessive or tail risk (smart beta).

Quants Liquid Alternatives are only offered to institutional and accredited investors.

Quants Liquid Alternative Funds Offer

- Smart beta portfolios that consists of the optimal combination of diversified asset allocations and risk management strategies.

- Composition of portfolios that generally consists of the large cap stocks, US government bonds and broad commodities.

- Risk management strategies with the proprietary derivative overlays for risk and return optimization

- Two times better distribution of monthly returns without tactical trading

- Rebalancing of portfolios on a monthly basis or whenever the asset distributions deviate more than 5%

2x Better Distribution of Monthly Returns

Benchmark is S&P 500 Index ETF (SPY)

Quants has built proprietary quantitative risk indices that deliver two times better distribution of monthly returns without tactical trading.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.